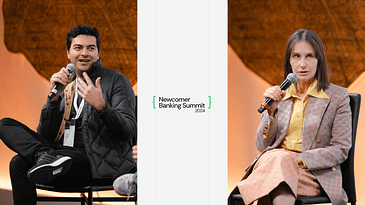

Today we’re highlighting two fireside chats from the Newcomer Banking Summit on March 14.

First up is Mercury CEO Immad Akhund. He talked about how the Silicon Valley Bank crisis sent customers rushing to his digital banking service.

He pitched a world where software — not human bankers — solve most of customers’ problems. Akhund told me, “My experience with relationship banking was I need to send a wire and I literally cannot figure out to do it, please help me. Which to me never felt like a relationship, it felt very transactional and painful — and with Mercury you don’t have to do that.”

Mercury is limited by the fact that it is not a bank — it’s a software company on top of banking partners — at a time when regulators are looking closely at how banks work with fintech partners.

We concluded our summit with Jackie Reses — who was a top executive at Square before leaving to buy a bank. Reses is the CEO of Lead Bank, a regional Kansas City bank that still serves local customers but has built an onramp for financial technology companies to connect with the banking system.

“The thing I saw at Square — which I consider to be a very strong, innovative fintech — is that owning a bank and operating a bank is a 10X delta in understanding compliance to working in a tech company,” Reses said. At Square, Reses said, she learned to “appreciate the complexity of what it takes to do this, so that we could learn how to serve our clients better and help them scale — but make sure we never put ourselves in the position to risk the relationship that we have operating with our regulators.”

You can give the episodes a listen or watch them on YouTube.

Also: The Future of Banking with Rho, Jiko, and Ripple

In case you missed it, we’ve posted another panel with three fintech/banking leaders.

Rho CEO Everett Cook, Jiko CEO Stephane Lintner, and Ripple President Monica Long are all trying to solve shortcomings in the legacy banking system, with different approaches. Check it out to see their takes on the major problems with banking today.

Get full access to Newcomer at www.newcomer.co/subscribe